Government Incentives for Renewable Energy Projects: Types, Benefits & Case Studies. In today’s article, lichcupdienevn.com will explore with you in the most detailed and complete way. See now!

Types of Government Incentives for Renewable Energy Projects

Government incentives play a crucial role in fostering the growth of renewable energy projects by addressing key challenges and encouraging private sector investment. These incentives act as powerful catalysts for the transition towards a cleaner and more sustainable energy future. Let’s delve into the different types of government support available:

Financial Incentives:

-

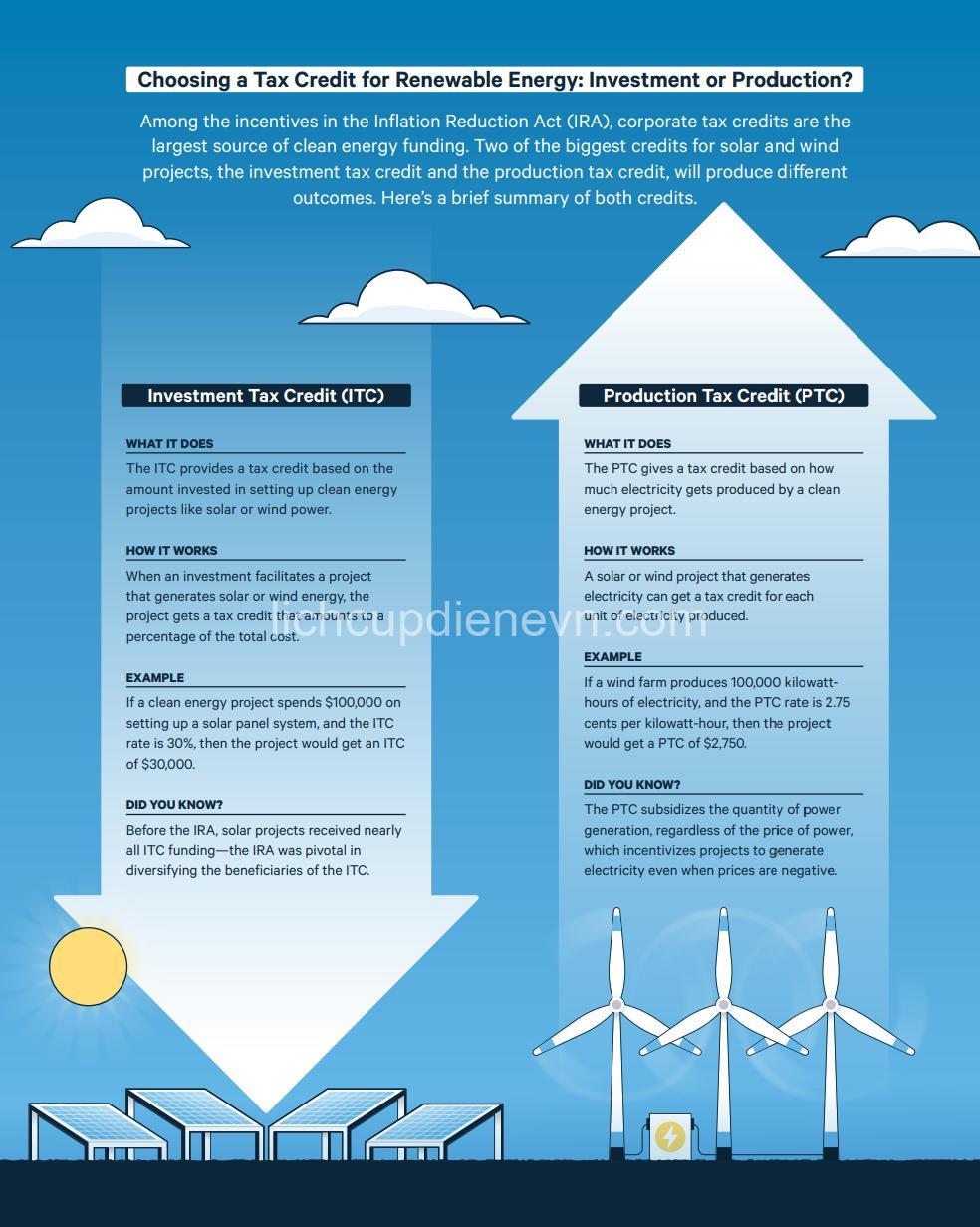

Tax Credits and Rebates: One of the most common types of incentives are tax credits and rebates. These offer financial rewards to individuals and businesses who invest in renewable energy technologies. Investment Tax Credits (ITC) provide a percentage reduction in the tax liability for the cost of installing renewable energy systems, while Production Tax Credits (PTC) offer a per-unit credit for electricity generated from renewable sources. Sales tax exemptions or reductions can also be offered, making renewable energy products more affordable.

-

Grants and Loans: Governments also offer grants to support research, development, and deployment of renewable energy technologies. These grants help fund innovative projects, drive technological advancements, and accelerate the adoption of clean energy solutions. Loan programs are another important financial incentive, offering loans with favorable interest rates to support renewable energy projects. These loans help overcome financial hurdles, making it easier for businesses and individuals to invest in renewable energy systems.

-

Feed-in Tariffs and Renewable Portfolio Standards: Feed-in tariffs (FiT) guarantee a fixed price for electricity generated from renewable sources, providing a stable revenue stream for renewable energy producers. Renewable Portfolio Standards (RPS) mandate utilities to source a certain percentage of their electricity from renewable sources, creating a guaranteed market for renewable energy generation.

Regulatory Incentives:

-

Streamlined Permitting Processes: Governments can streamline the permitting process for renewable energy projects, reducing administrative burdens and costs. This can involve simplifying the approval process, reducing paperwork, and expediting approvals.

-

Net Metering Policies: Net metering policies allow renewable energy generators to sell excess electricity back to the grid. This creates economic incentives for small-scale renewable energy installations by allowing individuals and businesses to offset their energy costs and even earn revenue from selling excess electricity.

-

Zoning Regulations: Zoning regulations can play a significant role in promoting renewable energy development by designating specific areas for solar farms, wind turbines, or other renewable energy projects. This ensures compatibility with existing land use and environmental regulations, facilitating the smooth integration of renewable energy projects into communities.

Benefits of Government Incentives for Renewable Energy Projects

Government incentives offer a myriad of benefits for renewable energy projects, contributing to a cleaner, more sustainable, and more prosperous future. Here are some of the key advantages:

-

Reduced Costs: Lowering Initial Investment Costs through tax credits, rebates, and grants makes renewable energy technologies more accessible and affordable, encouraging greater adoption. Promoting Competition and Innovation leads to further cost reductions in the long run as incentives drive technological advancements and encourage the development of more efficient and cost-effective renewable energy solutions.

-

Increased Investment: Attracting Private Sector Capital is crucial for scaling up renewable energy projects. Government incentives provide financial security and risk mitigation, making renewable energy investments more attractive to private investors. Creating a Favorable Market for renewable energy development attracts greater investment and stimulates overall economic growth.

-

Environmental Benefits: Renewable energy projects, supported by government incentives, significantly contribute to reducing greenhouse gas emissions, mitigating climate change, and improving air quality. This shift towards cleaner energy sources promotes sustainable development and a healthier environment for future generations.

-

Economic Growth: Job Creation in the Renewable Energy Sector provides new employment opportunities and stimulates economic activity in local communities. Promoting Technological Advancements drives innovation and creates new industries, contributing to a stronger and more diversified economy.

Case Studies of Successful Incentive Programs

Let’s examine some real-world examples of how government incentives have driven the growth of renewable energy:

-

Renewable Energy Tax Credits in the United States: The Investment Tax Credit (ITC) and the Production Tax Credit (PTC) have been instrumental in boosting the solar and wind energy sectors in the US. These tax credits have incentivized investment, spurred innovation, and significantly increased the deployment of renewable energy technologies.

-

Feed-in Tariffs in Germany: Germany’s Feed-in Tariffs (FiT) program, implemented in 2000, has been widely lauded for its success in driving the rapid expansion of renewable energy. This program guaranteed a fixed price for electricity generated from renewable sources, providing a stable and attractive investment opportunity.

-

Other Examples: Successful incentive programs exist in other countries as well, such as China, India, and the European Union. These programs often include a combination of financial incentives, regulatory support, and policy frameworks, demonstrating the multifaceted approach required for successful renewable energy development.

Challenges and Considerations for Government Incentives

While government incentives are crucial for promoting renewable energy, there are also challenges and considerations to be addressed:

-

Fiscal Sustainability: Balancing the cost of incentives with other government priorities is essential for ensuring fiscal sustainability. Long-term financial viability is crucial, avoiding dependence on subsidies and ensuring the effectiveness of incentive programs over time.

-

Efficiency and Effectiveness: Designing effective and targeted incentives is crucial for achieving desired outcomes and maximizing resource allocation. Monitoring and evaluating the impact of incentive programs is essential to optimize their effectiveness, adapt them to changing market conditions, and ensure they achieve their intended goals.

-

Public Acceptance: Addressing concerns about visual impacts, land use, and potential environmental effects of renewable energy projects is essential for gaining public acceptance. Promoting public education and engagement helps build understanding and support for renewable energy development.

Future Outlook for Government Incentives in Renewable Energy

The future of renewable energy is bright, and government incentives will continue to play a vital role in accelerating the clean energy transition.

-

Continued Growth of Renewable Energy: With ongoing support from government incentives, the renewable energy sector is poised for continued growth. This will lead to further cost reductions, technological advancements, and a greater reliance on clean energy sources.

-

Evolution of Incentive Policies: As the renewable energy landscape evolves, government incentives will need to adapt and evolve to meet changing market conditions and technology advancements.

-

Emerging Trends in Renewable Energy: Emerging trends in renewable energy, such as energy storage, smart grids, and the integration of different renewable sources, will require careful consideration and adjustments in incentive policies to ensure continued progress and overcome emerging challenges.

What are the main types of government incentives for renewable energy projects?

Government incentives for renewable energy projects can be categorized into two main types: financial incentives and regulatory incentives.

Financial incentives include tax credits and rebates, grants and loans, and feed-in tariffs and renewable portfolio standards. These incentives directly support the financial feasibility of renewable energy projects by reducing costs, providing funding, and guaranteeing revenue streams.

Regulatory incentives focus on creating a favorable regulatory environment for renewable energy projects, such as streamlined permitting processes, net metering policies, and zoning regulations. These incentives reduce administrative burdens, promote the integration of renewable energy into existing infrastructure, and address land use concerns.

How do government incentives affect the cost of renewable energy projects?

Government incentives can significantly reduce the cost of renewable energy projects, making them more attractive to investors and consumers. Tax credits and rebates directly reduce the upfront cost of installing renewable energy systems, making them more affordable. Grants and loans provide financial assistance, making it easier for individuals and businesses to invest in renewable energy.

Feed-in tariffs guarantee a fixed price for renewable energy generated, providing a stable and predictable revenue stream that reduces the financial risk associated with renewable energy investments. Streamlined permitting processes reduce administrative costs and delays, making renewable energy projects more efficient and less expensive to develop.

What are the environmental benefits of government incentives for renewable energy projects?

Government incentives for renewable energy projects play a crucial role in mitigating climate change and improving air quality. Renewable energy sources such as solar, wind, and hydropower produce clean energy with minimal emissions, reducing the reliance on fossil fuels and the associated pollution.

Incentives encourage the adoption of renewable energy, leading to a significant reduction in greenhouse gas emissions. This contributes to a healthier environment, combating climate change and protecting biodiversity.

How do government incentives contribute to economic growth?

Government incentives for renewable energy projects contribute to economic growth in several ways:

-

Job Creation: Renewable energy projects create new jobs in areas such as manufacturing, installation, maintenance, and research. This stimulates local economies and provides employment opportunities in a growing industry.

-

Investment and Innovation: Incentives attract private sector investment in renewable energy technologies, driving innovation and development of more efficient and cost-effective solutions. This leads to the creation of new industries and technological advancements that contribute to a more diversified and robust economy.

-

Energy Independence: Increased reliance on renewable energy sources reduces dependence on foreign energy imports, enhancing energy security and contributing to national economic resilience.

Conclusion

Government incentives are vital for the success of renewable energy projects. They reduce costs, attract investment, promote innovation, and create a more sustainable future. As you explore renewable energy options for your home or business, be sure to research the government incentives available in your area.

*You can find more information and resources on my website, lichcupdienevn.com. *

Let me know your thoughts and share your experiences with government incentives for renewable energy projects in the comments below!

Đỗ Ngọc Hằng