Renewable Energy Incentives for Businesses: Benefits & How to Access Them. In today’s article, lichcupdienevn.com will explore with you in the most detailed and complete way. See now!

Understanding Renewable Energy Incentives for Businesses

Renewable energy incentives are government programs designed to encourage businesses to adopt renewable energy sources. These incentives come in various forms, including tax credits, rebates, grants, loans, feed-in tariffs, and renewable energy credits.

The primary goal of these incentives is to bridge the gap between the cost of traditional energy sources and renewable energy technologies. By offering financial support, governments aim to make renewable energy more affordable and accessible for businesses.

Why are renewable energy incentives important for businesses?

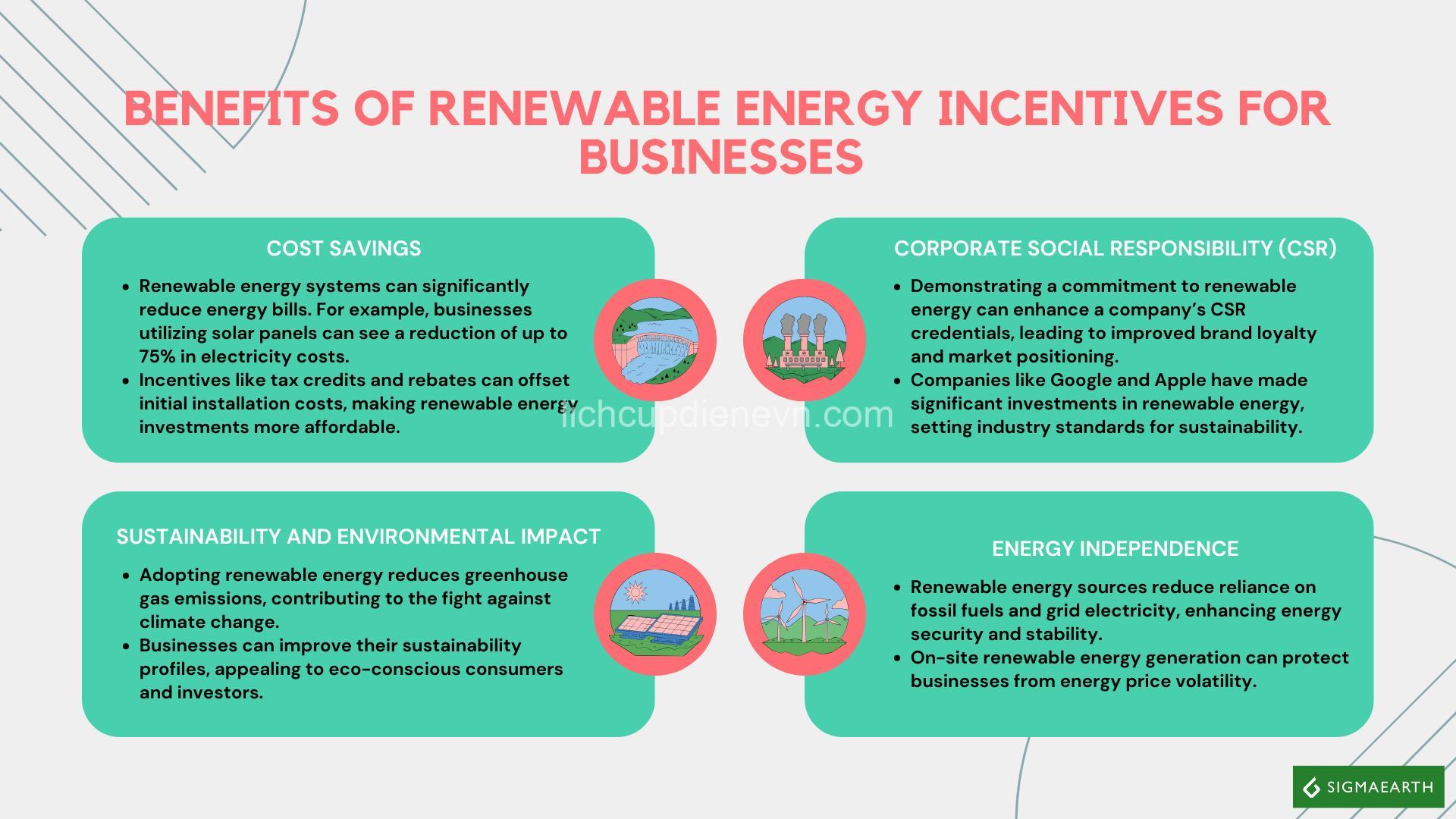

Beyond the financial benefits, renewable energy incentives offer a range of advantages that can significantly impact your business.

Environmental Sustainability: Adopting renewable energy sources contributes to a cleaner environment by reducing your carbon footprint and greenhouse gas emissions. This aligns with corporate social responsibility initiatives and enhances your brand reputation.

Financial Benefits: Renewable energy incentives can directly translate to reduced energy costs, leading to increased profitability and a stronger bottom line. Tax credits and rebates can provide immediate cash flow relief and financial savings.

Operational Benefits: Renewable energy can provide greater energy independence and resilience from volatile energy prices. By reducing your dependence on the grid, you can achieve greater stability and control over your energy supply.

Types of Renewable Energy Incentives for Businesses

Understanding the different types of incentives available is crucial for identifying opportunities that best suit your business needs.

Federal Incentives:

- Investment Tax Credit (ITC): The ITC is a tax credit offered for investments in solar, wind, geothermal, and other renewable energy systems. It allows you to deduct a percentage of the cost of your renewable energy installation from your federal income tax liability.

- Production Tax Credit (PTC): The PTC is a tax credit for wind energy projects that generates a set amount of revenue per kilowatt-hour (kWh) of electricity produced. This credit is designed to encourage the development and deployment of wind energy resources.

- Other Federal Incentives: The federal government also offers other incentives, such as accelerated depreciation and bonus depreciation, which allow businesses to deduct a larger portion of the cost of renewable energy equipment in the early years of ownership.

State Incentives:

- State Tax Credits and Rebates: Individual states often offer their own incentives to encourage renewable energy adoption within their jurisdictions. These incentives can include tax credits, rebates, and other financial support programs.

- State Grants and Loan Programs: Many states have grant and loan programs specifically designed to help businesses finance renewable energy projects. These programs typically offer low-interest loans, forgivable grants, or other forms of financial assistance.

- Net Metering Programs: These programs allow businesses that generate their own electricity through solar panels to sell excess energy back to the utility grid, earning credits that can offset their energy bills.

How to Access Renewable Energy Incentives

To access these valuable incentives, businesses need to follow a structured process:

Identify Eligible Incentives:

- Conduct comprehensive research on available incentives based on your business location, industry, and project type.

- Utilize online resources such as government websites, industry association websites, and renewable energy databases to gather information.

- Consult with energy consultants or financial advisors who specialize in renewable energy incentives.

Apply for Incentives:

- Understand the specific application processes for each incentive program.

- Familiarize yourself with the required documentation, such as project details, financial statements, and energy consumption records.

- Complete and submit applications diligently, ensuring accuracy and completeness.

Navigating the Process:

- Stay up-to-date on any changes in policy or program guidelines.

- Maintain compliance with all program requirements throughout the project lifecycle.

- Seek support from government agencies, industry experts, and energy consultants to navigate the complex process.

Benefits and Challenges of Renewable Energy Incentives

Benefits:

- Reduced Energy Costs: Renewable energy incentives can significantly reduce your energy expenses, contributing to improved profitability and a stronger financial position.

- Environmental Sustainability: Utilizing renewable energy sources showcases your commitment to environmental sustainability, enhancing your brand reputation and attracting environmentally conscious customers.

- Competitive Advantage: Adopting renewable energy demonstrates your commitment to green practices, giving you a competitive edge in the marketplace.

Challenges:

- Initial Investment Costs: The initial cost of installing renewable energy systems can be substantial, requiring careful financial planning and consideration of payback periods.

- Technical Complexities: Installing and maintaining renewable energy systems can involve technical complexities, necessitating expertise from qualified professionals.

- Permitting Processes: Navigating the permitting process for renewable energy projects can be complex and time-consuming, requiring coordination with local authorities.

- Land Availability: The availability of suitable land for renewable energy installations, particularly for larger projects, can be a challenge in certain areas.

- Policy Uncertainties: Changes in government policy or incentive programs can create uncertainty and impact the long-term viability of renewable energy investments.

Case Studies and Examples

Numerous businesses have successfully utilized renewable energy incentives to achieve significant benefits.

- Manufacturing companies have implemented solar panels to power their facilities, reducing energy costs and minimizing their environmental impact.

- Retail chains have leveraged wind energy to power their stores, demonstrating their commitment to sustainability and attracting environmentally conscious consumers.

- Tech firms have invested in geothermal energy for their data centers, ensuring reliable energy sources and minimizing their carbon footprint.

These case studies demonstrate the potential of renewable energy incentives to drive innovation, reduce costs, and enhance sustainability for businesses across various sectors.

FAQs about Renewable Energy Incentives for Businesses

What are the most common types of renewable energy incentives for businesses?

Renewable energy incentives come in various forms, including tax credits, rebates, grants, loans, feed-in tariffs, and renewable energy credits. The specific types of incentives offered vary depending on the federal, state, or local government program.

How can I determine which incentives are eligible for my business?

The eligibility criteria for renewable energy incentives depend on factors such as your business location, industry, project type, and investment amount. It’s essential to research available incentives through government websites, industry associations, and renewable energy databases. Consult with energy consultants or financial advisors to identify the most suitable incentives for your specific needs.

How do I apply for renewable energy incentives?

The application process for renewable energy incentives can vary depending on the program. It typically involves gathering project details, financial statements, energy consumption records, and other supporting documentation. The application process may also require consultation with qualified professionals, such as engineers or architects.

What are the potential benefits of utilizing renewable energy incentives?

Utilizing renewable energy incentives can offer significant benefits to businesses, including reduced energy costs, improved profitability, enhanced sustainability, and a positive brand reputation. These incentives can help businesses transition to cleaner energy sources, contributing to a more sustainable future.

What are the challenges associated with accessing and utilizing renewable energy incentives?

Challenges associated with renewable energy incentives can include navigating complex application processes, understanding eligibility criteria, finding qualified contractors, and managing the initial investment costs. It’s important to carefully research and plan your renewable energy project to mitigate these potential challenges.

Conclusion:

Exploring renewable energy incentives is a crucial step in driving sustainability and profitability for your business. By understanding the types of incentives available, their benefits, and the application process, you can make informed decisions about adopting clean energy solutions. Visit lichcupdienevn.com for more information on electrical and plumbing solutions, and feel free to share your thoughts and experiences in the comments section. Let’s work together to create a more sustainable future!

Note: This content is intended for informational purposes only and should not be considered financial or legal advice. Consult with qualified professionals for specific guidance on renewable energy incentives.